Private Student Loan Forgiveness, Consolidating Private Student Loans, and Relief Options

Student loans play a significant role in enabling students to pursue higher education. While federal student loans are more common and offer various forgiveness programs, private student loans are a different story. This article aims to provide a comprehensive understanding of private student loan forgiveness, consolidating private student loans, and the options available for relief.

Introduction to Private Student Loans

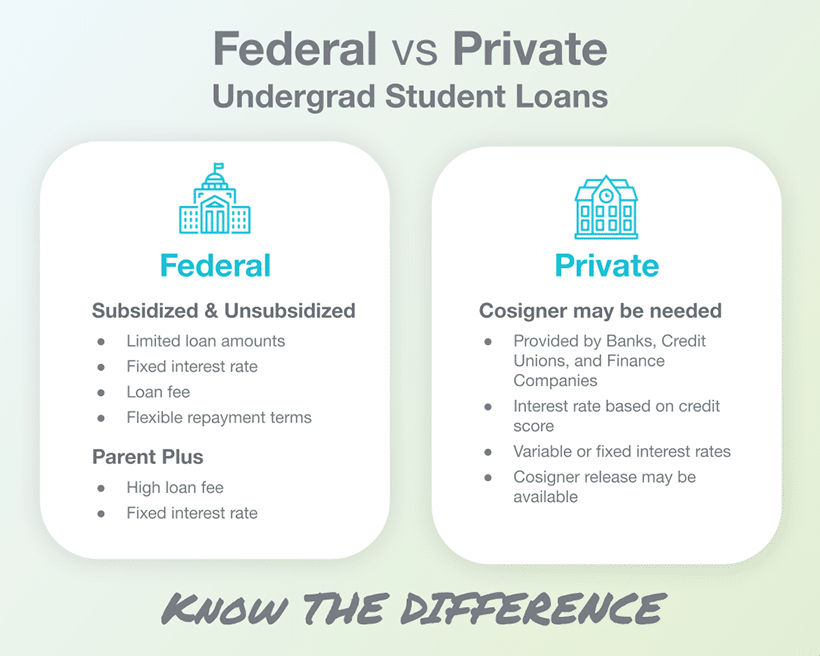

Private student loans are loans taken from private lenders to cover education-related expenses. Unlike federal student loans, private student loans are not subsidized by the government and typically have higher interest rates. They are offered by banks, credit unions, and other financial institutions.

Understanding the Need for Loan Forgiveness

Loan forgiveness is a crucial aspect of student loan management. It offers relief to borrowers by canceling a portion or all of their outstanding loan balance under specific circumstances. While federal student loans have forgiveness programs like Public Service Loan Forgiveness (PSLF) and Income-Driven Repayment (IDR) plans, private student loans generally do not provide the same forgiveness options.

The Difference Between Federal and Private Student Loans

Before diving into private student loan forgiveness, it is essential to understand the fundamental differences between federal and private student loans. Federal loans are backed by the government and come with borrower protections, such as income-driven repayment plans and loan forgiveness programs. On the other hand, private student loans are issued by private lenders, have varying interest rates, and often require a cosigner.

Can Private Student Loans Be Forgiven?

Private student loan forgiveness is rare but possible. Unlike federal loans, private student loans do not have standardized forgiveness programs. However, some private lenders offer limited forgiveness options in certain cases, such as permanent disability or death of the borrower. It is crucial to check with individual lenders to explore potential forgiveness possibilities.

Exploring Private Student Loan Relief Options

While forgiveness may be challenging, borrowers with private student loans still have relief options to manage their debt effectively. These options include repayment plans, loan consolidation, and refinancing.

Repayment Plans

Some private lenders offer flexible repayment plans to help borrowers in challenging financial situations. These plans may include reduced monthly payments, interest-only payments, or temporary forbearance options. Contacting the lender directly and explaining the financial hardship is the first step to exploring these possibilities.

Loan Consolidation

Consolidating private student loans involves combining multiple loans into a single loan, often with a lower interest rate and extended repayment term. It simplifies loan management by having a single monthly payment. However, weighing the pros and cons before considering consolidation is essential.

Refinancing

Refinancing private student loans involves taking out a new loan with a private lender to pay off existing loans. This could lower the interest rate and monthly payments. However, refinancing may only be suitable for some, as it may result in the loss of certain borrower protections provided by federal loans.

Eligibility Criteria for Private Student Loan Relief

Eligibility for private student loan relief varies depending on the lender and option chosen. Generally, financial hardship is a common requirement, and lenders may consider factors such as credit history, income, and debt-to-income ratio. It is crucial to review the specific eligibility criteria of each relief option and consult with the lender to determine qualification.

Pros and Cons of Consolidating Private Student Loans

Consolidating private student loans can offer several benefits, such as simplifying payments, lowering interest rates, and extending the repayment term. However, it is essential to consider the potential drawbacks, such as the loss of certain federal borrower protections, potential fees, and longer repayment periods.

Tips for Successfully Consolidating Private Student Loans

Consolidating private student loans requires careful consideration and planning. Here are some tips to help borrowers successfully navigate the consolidation process:

- Research and compare different lenders to find the best interest rates and terms.

- Review the terms and conditions of the consolidation loan, including any fees or penalties.

- Consider the impact on the overall cost of the loan and the monthly payment amount.

- Evaluate the potential loss of federal loan benefits and weigh the trade-offs.

- Consult with a financial advisor or student loan expert for personalized guidance.

Alternative Strategies for Managing Private Student Loan Debt

If private student loan forgiveness or consolidation is not feasible, alternative strategies for managing the debt exist.

Income-Driven Repayment Plans

Some private lenders offer income-driven repayment plans similar to federal loans. These plans calculate monthly payments based on the borrower’s income and family size, providing more affordable options for repayment.

Financial Hardship Programs

In cases of financial hardship, some private lenders may have hardship programs that offer temporary payment reductions or deferment options. It is crucial to contact the lender directly and explore available programs.

Negotiating with Lenders

Borrowers facing financial difficulties can try negotiating with their private lenders. Explaining the situation, providing supporting documentation, and requesting more favorable repayment terms or interest rates may lead to mutually beneficial agreements.

How to Apply for Private Student Loan Relief

To apply for private student loan relief, borrowers should contact their lenders directly. Lenders will provide the necessary application forms and instructions. Preparing relevant financial information, hardship documentation, and any other supporting materials requested by the lender is essential.

The Impact of Private Student Loan Forgiveness on Credit Score

When available, Private student loan forgiveness can have positive and negative effects on a borrower’s credit score. The forgiven amount may be reported as income, potentially affecting the borrower’s tax liability. Additionally, the forgiveness process itself may temporarily lower the credit score. It is advisable to consult with a financial advisor or tax professional to understand the potential implications.

Common Misconceptions About Private Student Loan Forgiveness

Several things could be improved surrounding private student loan forgiveness. Some borrowers may mistakenly believe that private loans are automatically forgiven after a certain period or have the same forgiveness options as federal loans. It is essential to separate fact from fiction and understand the specific terms and conditions of private loan agreements.

The Importance of Seeking Professional Advice

Navigating the complexities of private student loans and relief options can be challenging. Seeking professional advice from financial advisors, student loan experts, or credit counselors can provide valuable insights and personalized guidance based on individual circumstances. These professionals can help borrowers make informed decisions and create effective strategies for managing student loan debt.

Conclusion

Private student loan forgiveness may be limited, but borrowers still have options for relief. Consolidating private student loans, exploring repayment plans, and considering alternative strategies can provide much-needed assistance. Understanding the eligibility criteria, weighing the pros and cons, and seeking professional advice when managing private student loan debt are essential. By taking proactive steps, borrowers can work towards financial stability and repay their private student loans.

FAQs

Can private student loans be forgiven entirely?

Private student loan forgiveness is rare but possible. Some private lenders offer limited forgiveness options in certain circumstances, such as permanent disability or death of the borrower. It is crucial to check with individual lenders to explore potential forgiveness possibilities.

What is the difference between federal and private student loans?

Federal student loans are backed by the government and come with borrower protections, such as income-driven repayment plans and loan forgiveness programs. On the other hand, private student loans are issued by private lenders and often have higher interest rates and fewer forgiveness options.

Is consolidating private student loans a good idea?

Consolidating private student loans can benefit some borrowers, as it simplifies loan management and may lower interest rates. However, it is essential to consider the potential loss of federal loan benefits and weigh the pros and cons before opting for consolidation.

Are there alternatives to private student loan forgiveness?

If private student loan forgiveness is unavailable, borrowers can explore alternative strategies such as income-driven repayment plans, financial hardship programs, or negotiating with lenders. Seeking professional advice can provide personalized guidance based on individual circumstances.

What should I do if I’m struggling with private student loan debt?

Contact your lender to explore available relief options if you’re struggling with private student loan debt. Consider alternative strategies, consult with professionals, and create a comprehensive plan to manage your debt effectively.